They say the only things certain in life are death and taxes. This blog has already featured several posts about death including: leading causes of death by state, unnatural ways Americans die abroad, and even how major diseases traveled the globe. Now that I’m sitting down to talk with my wife about our taxes (she does the heavy lifting), I thought it’s about time I tackled the other certainty. After all, what’s more popular than death and taxes?

Apologies

My apologies to international readers (or is it reader?) of this blog. I had planned to write a post about international tax freedom day, but I had trouble finding a usable map. FWIW, I usually dedicate an hour or two selecting the right map. Thanks to a nasty bout of food poisoning (is there any other kind?), I spent a little less time on this one. As such, this post focuses solely on the additional tax burden faced by residents of each US state.

Background

In general US residents pay the same federal taxes regardless of which state they live in. This is particularly true under the current tax laws which capped the amount of state and local taxes filers can deduct from their federal income. Therefore the state and in many cases county, town, or city you live in drives most of the difference in the taxes you pay. Local taxes fall into three broad categories, income, real estate, and sales levies. Eight states have no income taxes (New Hampshire doesn’t tax earned income, but does tax investment income). All states levy real estate taxes on homes. The rates vary from as low less than 0.5% to more than 4.0%. State rules about assessments, contesting taxes, and rate changes can be quite convoluted. One county taxed my home at X% of 25% of it’s assessed value in 1969, making it hard to contest since my house was built in 2003. Five states levy no broad state-wide sales tax, but in some their localities do and at least one has high sin taxes (alcohol and tobacco). Many states with higher rates also exempt food, medicine, or clothes up to a certain value. Some with low rates apply it to everything.

Results

Based on that brief outline, it’s quite a task to calculate each state’s tax burden. The good people at Datapandas.org not only complied the data, they also created our featured map.

It comes as no surprise that New Yorkers carry the highest tax burden (15.9%) followed closely by Connecticut (15.4%) and Hawaii (14.1%). At the other end, Alaska’s low population and vast resource wealth leave it the undisputed champ at 4.6%. Wyoming’s mineral wealth and smallest state population allow it to edge out the bustling state of Tennessee (7.5% vs. 7.6%).

Your Mileage May Vary

As a resident of the great state of New York, I can affirm that taxes are nominally high. With our children making their own way in the world, we have often thought of relocating. We employ a financial advisor who has sophisticated retirement planning tools to help with these types of things. Using these tools, we compared New York to Pennsylvania (10.6%) and Ohio (10.0%). Surprisingly to both us and our advisor, New York wasn’t the most expensive. To be fair, the difference was only several hundred dollars, which is certainly within the error frame or our data. The point is these types of maps are useful in aggregate, but they’re not great at projecting individual results.

Final Note

As for retirement, that’s an entirely different problem. Some states tax everything, some exempt Social Security, others exempt government pensions, some railroad pension, etc. Bottomline, there are dozens if not hundreds of sites that can offer help in figuring out retirement costs. However, just like the map above, most provide average aggregate data.

As always thanks for reading.

Armen

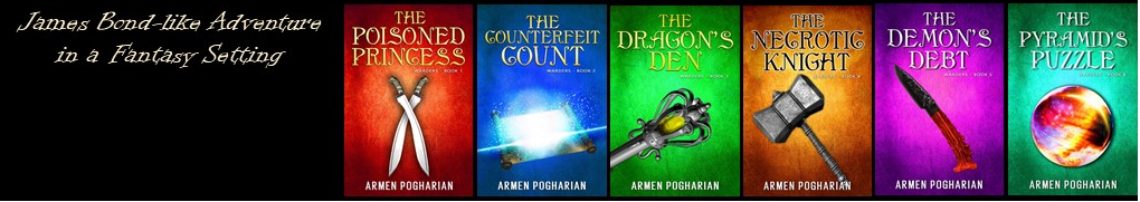

Note to pay the bills: If you’re interested in a PG-rated James Bond-like thriller in a high fantasy setting, check out a summary of the Warders series here or find links to purchase books here.

As an aside please consider signing up for my FREE author newsletter. It will contain opportunities to preview new books, announcements, and contests related to my novels. It will not overwhelm your inbox – I’m thinking once a month or less depending on news.

If you have subscribed, but haven’t received a newsletter, please check your spam folder. Moving the newsletter to your inbox should fix the issue.