Is lithium as valuable as gold? Strictly speaking, no. Today’s market quote for gold is $55,643 per kilogram. For that money you can buy nearly 6,000 kilograms of lithium carbonate (99.5%) or lithium hydroxide monohydrate (56.5% pure). So, what’s all the hype about?

Basics

Lithium is the third element on the periodic table and the lightest solid. It is a highly reactive alkali metal that never occurs freely in nature. Compounds containing the element are widely distributed making it the 25th most abundant element in the Earth’s crust. It can also be found in seawater. The greatest concentrations, nearly 30 times that of open water, are found near hydrothermal vents.

Why do we care?

Lithium compounds feature prominently in ceramics, lubricating grease, and metallurgy. Medical uses include treatment for bipolar disorder and other depressive issues. As important as those applications are, they are not driving demand for the metal. That honor belongs to rechargeable batteries.

With its low atomic mass and high electrode potential, lithium delivers very high energy density at a relatively low weight. This combination makes lithium-ion batteries the go to standard for portable electronics, aerospace applications, and electronic vehicles (EVs). There are roughly 1.4 billion motor vehicles in the world. That represents less than 1 per every 5 humans on the planet. With a growing population and rising incomes, the number of vehicles could more than double by 2050.

Rise of the EV

As part of the global effort to combat climate change, the world is moving toward alternatives to the internal combustion engine (ICE). While fuel cells once looked like the best bet, EVs and their cousin plug-in hybrids have taken the lead. Cumulative sales reached 1 million in 2015 and surpassed 10 million in 2020. Half of that growth occurred between 2018 and 2020. While impressive, that is under than 3% of worldwide sales and represents less than 1% of the vehicles on the road.

Elon Musk, the billionaire founder of EV maker Tesla, is planning for that growth to continue with EV sales reaching 30 million in seven years. While specifics vary by vehicle, the average EV battery pack needs ~10 Kg of lithium. Building 30 million vehicles requires ~1.6 million tons of mined lithium carbonate. The current annual supply is ~400,000 tons, and only a third goes to EVs.

It doesn’t take a math or econ wizard to realize there’s a disconnect between supply and the growing demand. Companies are racing to develop new sources. As with past ‘resource rushes’ there are many concerns, both financial and environmental. That leads us to our Map Monday feature courtesy of ScienceDirect.com.

As always thanks for reading

Armen

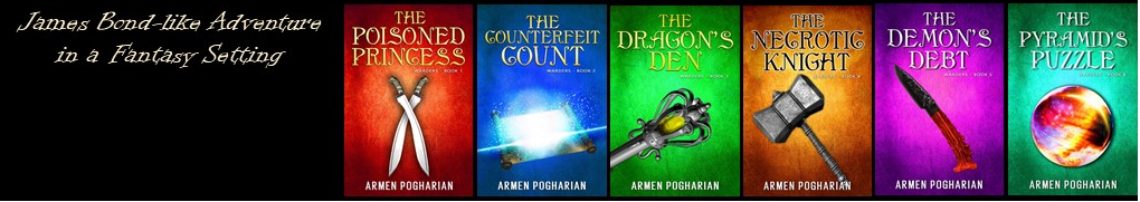

Note to Pay the Bills: You’ll have to read more than 150K words before you discover Lithium in the Misaligned series. I don’t want to spoil the surprise, but it has something to do with radiation. How does radiation fit into a Young Adult fantasy series about Welsh mythology? Learn more by reading a summary of the series here or find links to purchase books here.

As an aside please consider signing up for my FREE author newsletter. It will contain opportunities to preview new books, announcements, and contests related to my novels. It will not overwhelm your inbox – I’m thinking once a month or less depending on news.

If you have subscribed, but haven’t received a newsletter, please check your spam folder. Moving the newsletter to your inbox should fix the issue.

As your map shows, Bolivia has the largest known reserve of Lithium at the salt flats of Uyuni. Elon Musk who needs Lithium for the Tesla batteries, referring to the 2019 coup in Bolivia, reportedly said on Twitter, “We will coup whoever we want.” Not a nice thing to say. The Bolivian coup failed. I wonder how much the Bolivians are charging him for their Lithium.